|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan with Bad Credit: A Beginner’s GuideRefinancing a home loan with bad credit can seem daunting, but with the right approach and understanding, it can lead to financial relief and better loan terms. This guide will help you navigate the process and explore your options. Understanding RefinancingRefinancing involves replacing your current mortgage with a new one, ideally with better terms. This can help lower your monthly payments, change your loan type, or adjust your interest rate. Why Consider Refinancing?

Challenges of Refinancing with Bad CreditBad credit can make refinancing more difficult but not impossible. Lenders may see you as a higher risk, which could affect the terms offered. However, there are strategies to improve your chances. Improve Your Credit Score

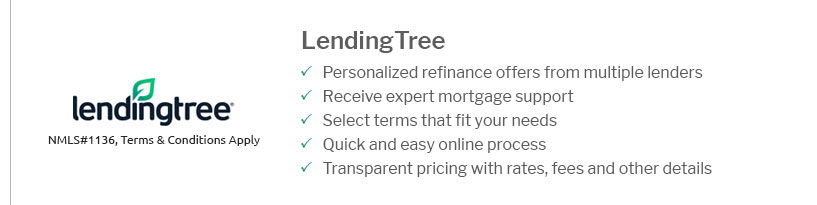

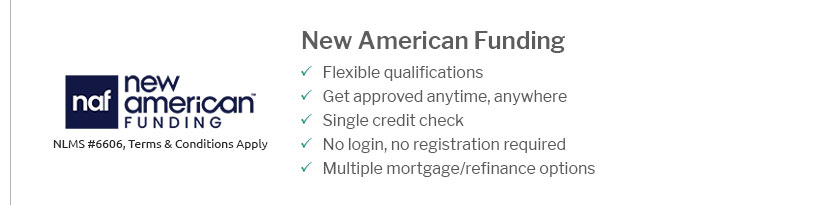

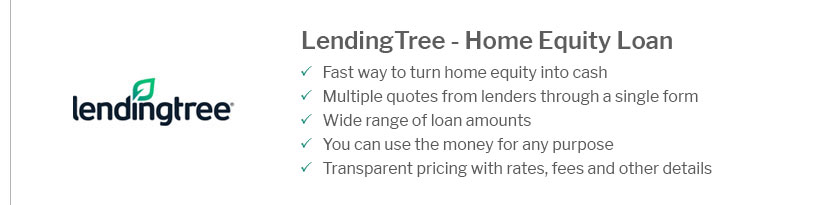

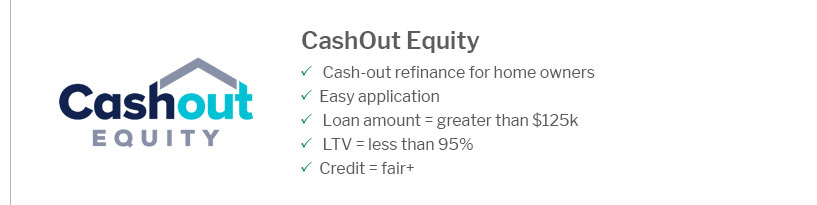

Consider visiting should i refinance my va mortgage for more insights into refinancing options. Finding the Right LenderNot all lenders are the same. Some specialize in working with individuals with bad credit. Research and compare lenders to find the best fit for your situation. Steps to Refinance a Home Loan with Bad CreditHere’s a step-by-step guide to help you through the refinancing process. 1. Assess Your Financial SituationReview your current financial status, income, and expenses to determine what you can afford. 2. Shop for LendersLook for lenders who offer competitive rates and are willing to work with those with less-than-perfect credit. 3. Gather DocumentationPrepare necessary documents such as income statements, tax returns, and credit reports to streamline the application process. 4. Apply for RefinancingSubmit your application and wait for the lender's response. Be prepared to negotiate terms if needed. More detailed guidance can be found at should we refinance our home mortgage, where comprehensive insights are shared. Frequently Asked QuestionsCan I refinance my home loan with a credit score under 600?Yes, it is possible to refinance with a credit score under 600, but you may need to work with specialized lenders and might face higher interest rates. What are the benefits of refinancing with bad credit?Refinancing can offer benefits such as lower monthly payments, improved loan terms, and access to cash through equity, even for those with bad credit. How can I increase my chances of approval?To increase approval chances, improve your credit score, reduce existing debts, and provide comprehensive documentation to potential lenders. https://money.usnews.com/loans/mortgages/articles/can-you-refinance-with-bad-credit

Mortgage lenders typically look for a credit score of at least 620 to refinance conventional loans, but standards can be more flexible with government-backed ... https://www.miamiherald.com/banks/mortgage-refinance/refinance-mortgage-bad-credit/

It's not impossible to refinance a mortgage with bad credit. Still, it can be challenging unless you do your homework first. https://themortgagereports.com/23319/7-mortgage-programs-low-minimum-credit-score

You can qualify for an FHA loan with a low credit score of 500 and a 10% down payment, or 3.5% down if your FICO is 580 or above. FHA loans ...

|

|---|